At the beginning of the Cold War, both the US and Soviet Union could produce key military technologies such as nuclear weapons and long range delivery systems. However, by the end of the Cold War, there was a clear gap in military power.

The key transformative force in military power over the period was the application of computing to the military systems. The chip industry is the main driver behind the computing power.

There was not a knowledge gap that can explain why the Soviet Union did not acquire and deploy the technology. They knew the importance of computing technology earlier than the US but they lost in terms of producing the technology despite having all the resources to do so. They had the expertise, huge financial resources particularly the defense budget as well as an economy that focused on producing technologies for military systems since Stalin’s industrialization in the 1920s.

Silicon Valley, the world-renowned technology hub was born as the Stanford Research Park was established in 1951 and became the game changer which gives the US the competitive edge as the world superpower. The history of Silicon Valley dates back to the early 1900s as the San Francisco Bay had long been a major site of US military research and technology.

Interestingly, the initiative to establish the Stanford Research Park was led by Stanford University and private companies. The government plays an indirectly critical role as the major customer of military technologies that promotes the development of Silicon Valley.

The world’s economy is reliant upon semiconductor chips because the computing power accessed through microchips is required for all parts of the global economy from smartphone and household appliances to data centers and AI technology.

Professor Chris Miller discussed in his book “Chip War: The Fight for the World’s Most Critical Technology” about how the US has maintained its lead as a superpower by dominating advances in computer chips and all the technology that chips have enabled. However, that edge is in danger of slipping and the battle to control the chip industry will shape the future.

The global semiconductor production system is complex and highly integrated. Each of the five major global semiconductor producers – the US, Taiwan, Japan, South Korea and China is also a large chip importer. The US and South Korea specialized in producing complex, high-value chips but they import simpler, low-value chips from abroad.

On the other hand, Japan and China specialized in producing simpler chips used in automobiles, household appliances and consumer goods. China is the largest export destination for the other four major chip manufacturers.

The struggle to influence and control the supply chains of machines, software and materials needed to make chips explains the shifting military balance during the Cold War and the US-China trade war today. No other industry in the world economy is so defined by a small number of companies, oligopolies and monopolies in certain cases whereby only one company in the world has the unique capability to produce certain technology needed to make an advanced chip.

Semiconductors are created by precise manufacturing that involves the most complex machines, the most purified materials, and the most expensive and specialized manufacturing processes that humans have ever undertaken. The chips that power all devices could only be produced by a tiny number of companies using machine tools that are produced by some companies in the world, all of which require US technology.

For instance, advanced semiconductors are designed using the softwares developed by three US companies and only three companies are capable of making PC processors, namely Apple, Intel and AMD. Moreover, only a handful of companies, mostly US companies, have the expertise in chip design such as Nvidia, Qualcomm, Texas Instruments and Micron other than foreign companies like MediaTek in Taiwan and Arm, a UK company owned by the Japanese Softbank Group.

Following the design process is the manufacturing process which is the hardest part in producing microchips. Although the materials to produce chips such as silicone is abundant in the Earth’s crust, the gasses and chemicals involved in chip making need to be perfectly pure to prevent defects. The ability to purify materials with almost perfect precision is something that only a small number of companies in the world can do, largely Japanese companies.

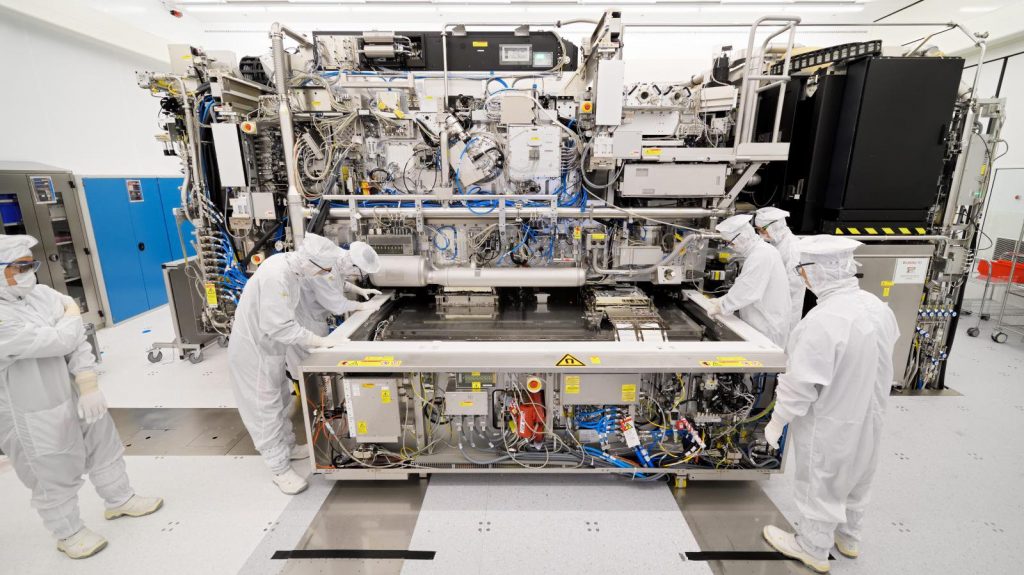

The most complex machine to manufacture an advanced chip is the extreme ultraviolet (EUV) lithography machine which is only produced by the ASML company in the Netherlands. Finally, the chip manufacturer has to bring all the materials, software, tools, designs and machines together to manufacture the chips. This is why an advanced chip making facility today costs around $20 billion or $25 billion, one of the most expensive factories in human history.

This is also why only three companies have the ability to produce advanced processor chips: Intel in the US, Samsung in South Korea and in the leading position, the Taiwan Semiconductor Manufacturing Company (TSMC). TSMC is the only company in the world that is not designing chips, only manufacturing.

However, its business model lets it gain economies of scale in both technological and financial terms far beyond its rivals. Taiwan now produces one third of the world’s computing power and the global economy hinged on peace in Taiwan.

Chip production is a process that has been shaped by political choices in the US and in other countries. It has been politicized from day one because the industry emerged out of the Cold War military industrial complex. Since the middle of the Cold War, the US government has been very deliberate in trying to bind other countries to it by bringing them into electronics and semiconductor supply chains.

And similarly, key countries in Asia like South Korea, Taiwan, Japan and Singapore have deliberately targeted participation in electronic and semiconductor manufacturing supply chains to bind themselves to the US.

Extraordinary economic efficiencies have been gained by creating this complex international supply chain but in the past seven or eight years, politics has begun to intrude into the chip supply chain in ways that were unexpected by many key players. The first political challenge to the contemporary shape of the semiconductor supply chain came from China.

Today, the Chinese government believes that semiconductors are their most important vulnerability because they spend more money importing semiconductors than oil. China’s leaders fear that their reliance on imported chips was not only an economic vulnerability, but also a strategic vulnerability.

In 2014, China launched a number of policy programs designed to wean China off reliance on imported chips and build up domestic chipping capabilities. And this began to set off alarm bells across the region, first off in Taiwan, Japan, and then later in the US, which was concerned that this industrial policy program might succeed at winning China substantial market share and threatening the profitability of US firms, while also giving China access to cutting-edge technologies.

There has been a deep relationship between computing capabilities and intelligence and military capabilities from the earliest days. Professor Miller projected that weapons factories in the future are data centers because data centers train systems to operate more effectively. So the US was looking at China’s efforts to move forward in building technologies as strategic ramifications. If the gap between US and China computing capabilities decline, there will be inevitable ramifications for both intelligence and military systems.

Therefore, from the Pentagon’s perspective, there is a direct implication for the military power balance as to whether China’s efforts would succeed or fail. As a result, the US has responded with a number of different measures:

- Introducing the CHIPS Act, which is designed to put more money into the US chip industry with tools, first as an insurance policy in case there is a war in the Taiwan Straits, and second, to try to boost the amount of R&D in the chip industry to keep America’s technological advantage over China.

- Restrict the transfer of certain tools to Chinese chip firms. And, in particular, the US is focused on two types of tools, the software tools that design chips and the machine tools that manufacture chips. Because all the software tools are used by US firms, and because all of the critical machine tools are produced either in the US or Japan or the Netherlands, the West, in aggregate, has a lot of influence over whether or not China can acquire the relevant tools.

Will China tolerate it? The challenge that China faces is trying to keep foreign companies invested and keep R&D relationships viable. So, disruptive steps that China takes can hasten the process of decoupling. Professor Miller argued that the US is in a position of escalation dominance in this sphere because the US is severing relationships, and China can’t retaliate because it will cause Western companies to pull back from China.

On the other hand, Dr Lee Kai Fu in his book “AI Super Sowers – China, Silicon Valley, and the New World Order” expects the balance of AI capabilities between the US and China to shift in China’s favor, despite the US enjoying a first-mover advantage for now.

The US’s lead in AI expertise carries less importance because the age of AI has transformed into implementation from invention. Chinese AI entrepreneurs are not simply copy-cats lacking in innovation power and they have access to the world’s largest data supply as well as support from the government determined for China to become an AI superpower.

In short, the chip industry now determines both the structure of the global economy and the balance of geopolitical power. The AI new world order is fast approaching bi-polarity and the gap between the US and China as well as the rest of the world is widening every day.

Dr. Adilah Zafirah Mohd Suberi

Penyelidik, Bahagian Kajian IRIS Institute